Benefits of Using a Radar Signal Trading System

Utilizing a radar signal trading system can offer traders the advantage of making data-driven decisions in the ever-changing financial markets. By employing advanced algorithms and technology, these systems can analyze market trends and provide real-time signals for potential trading opportunities. This can help traders save time and effort in manual market analysis, allowing them to focus on executing trades effectively.

Moreover, radar signal trading systems can help traders in minimizing emotional decision-making during trading. Emotions such as fear and greed can often cloud judgment and lead to impulsive trades, resulting in losses. With a systematic approach based on statistical data and signals generated by the system, traders can reduce the impact of emotions on their trading decisions and improve their overall trading performance.

Digital trading app like digital trading app can revolutionize the way traders engage with the financial markets. With the convenience of accessing real-time market data and analytics at their fingertips, users can make informed decisions and execute trades with ease. The user-friendly interface and advanced features of a digital trading app streamline the trading process, allowing traders to stay ahead of market trends and seize profitable opportunities. Whether you are a beginner or an experienced trader, incorporating a digital trading app into your trading routine can enhance your overall trading experience and potentially boost your trading performance.

Understanding How Radar Signal Trading Systems Work

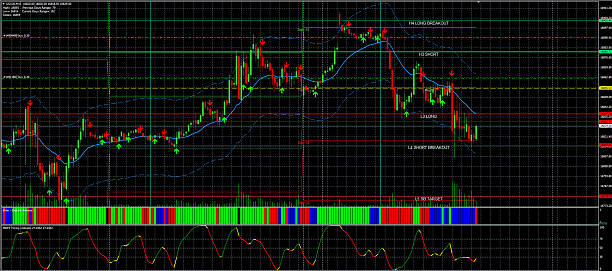

A Radar Signal Trading System operates by using complex algorithms to analyze financial data, market trends, and trading patterns. These systems are designed to identify potential trading opportunities by generating buy or sell signals based on predetermined criteria. Traders can then use these signals to inform their trading decisions, helping them to execute trades with more precision and speed.

Through the use of historical data, technical indicators, and mathematical models, Radar Signal Trading Systems aim to provide traders with insights into market movements and trends. By continuously scanning the markets for opportunities and analyzing various factors simultaneously, these systems can help traders make informed decisions and potentially increase their chances of success in the fast-paced world of trading.

Key Features to Look for in a Radar Signal Trading System

When considering a radar signal trading system, it is essential to look for key features that can enhance your trading experience. One crucial feature to prioritize is real-time data and analysis capabilities. A reliable system should provide up-to-the-minute information on market trends, allowing you to make informed decisions promptly. This real-time functionality can give you a competitive edge in a fast-paced trading environment.

Another important feature to consider is customization options. A flexible radar signal trading system should allow you to tailor settings to your trading preferences and risk tolerance levels. Look for systems that offer a range of parameters that you can adjust to align with your unique trading strategy. Customization can help optimize the system to suit your specific needs and increase the likelihood of achieving your trading goals.

When considering a radar signal trading system, it is crucial to prioritize features that can enhance your trading experience. One key feature to look for is real-time data and analysis capabilities, which provide up-to-the-minute information on market trends. This functionality can give you a competitive edge in a fast-paced trading environment. Additionally, customization options are important for tailoring settings to your trading preferences and risk tolerance levels. By choosing a flexible radar signal trading system with a Margin Trading Facility, such as the one offered by CloudTradeTech, you can optimize the system to align with your unique trading strategy and increase the likelihood of achieving your trading goals.

Choosing the Right Radar Signal Trading System for You

When selecting the right radar signal trading system for yourself, it is crucial to first determine your individual trading goals and preferences. Consider factors such as your risk tolerance, preferred trading style, and level of experience in the financial markets. By identifying your specific needs and requirements, you can narrow down the list of available radar signal trading systems to find one that aligns with your objectives.

Another important aspect to consider when choosing a radar signal trading system is the level of technical analysis and customization capabilities it offers. Look for a system that provides a wide range of technical indicators, charting tools, and customization options to tailor the system to your unique trading strategy. Additionally, ensure that the system’s user interface is intuitive and user-friendly, as this will simplify the trading process and help you make informed decisions quickly. By selecting a radar signal trading system that meets your individual criteria, you can enhance your trading experience and increase your chances of success in the financial markets.

Tips for Maximizing Your Trading Success with a Radar Signal Trading System

To maximize your trading success with a radar signal trading system, it is crucial to stay disciplined and stick to your predetermined trading strategy. Emotions can often cloud judgment and lead to impulsive decisions that may not be in line with your trading plan. By following your signals and not deviating from your established rules, you can avoid unnecessary risks and optimize the potential for profitable trades.\

Additionally, it is essential to continuously monitor and evaluate the performance of your radar signal trading system. Regularly review your trading results to identify any patterns or areas for improvement. By analyzing your trades and making adjustments as needed, you can fine-tune your strategy and increase your chances of success in the dynamic world of trading.

Online Share Trading is a popular method for investors to buy and sell stocks through an online platform. When utilizing a radar signal trading system for your online share trading activities, it is important to maintain discipline and adhere to your trading strategy to maximize success. Emotions can often lead to impulsive decisions that may not align with your plan, so it is crucial to follow the signals and rules you have set. By staying focused and avoiding unnecessary risks, you can optimize your potential for profitable trades. Regularly monitoring and evaluating the performance of your radar signal trading system is also essential. By analyzing your trades and making adjustments as needed, you can fine-tune your strategy and increase your chances of success in the dynamic world of Online Share Trading. For more information on Online Share Trading, visit Online Share Trading.

Common Mistakes to Avoid When Using a Radar Signal Trading System

One common mistake to avoid when using a radar signal trading system is relying too heavily on the signals without conducting additional analysis. While radar signals can provide valuable insights, it is essential to use them as one of many tools in your trading strategy. Failing to consider other factors such as market trends, news events, and risk management techniques can lead to making poor trading decisions based solely on the radar signals.

Another mistake to steer clear of is ignoring the importance of backtesting the radar signal trading system. Backtesting involves analyzing the performance of the trading system using historical data to evaluate its effectiveness. By skipping this crucial step, traders may not fully understand the strengths and weaknesses of the radar signal system, potentially leading to unexpected outcomes in live trading. Conducting thorough backtesting can help refine trading strategies and improve overall performance when utilizing a radar signal trading system.

Real-Life Success Stories of Traders Using Radar Signal Trading Systems

A trader named Sara had been struggling to find consistency in her trading endeavors. That changed when she started using a radar signal trading system. With the system’s clear buy and sell signals, Sara was able to make well-informed decisions quickly, resulting in a significant increase in her profitability. She attributes much of her success to the system’s ability to filter out market noise and provide her with accurate trading opportunities.

Another trader, Alex, had been overwhelmed by the complexities of technical analysis and market research. However, after implementing a radar signal trading system into his strategy, he found that the system simplified the process for him. By following the system’s signals, Alex was able to execute trades with more confidence and precision. As a result, his trading performance improved, leading to consistent profits and a newfound sense of control in his trading activities.

The Future of Trading with Radar Signal Trading Systems

As technology continues to advance at a rapid pace, the future of trading with radar signal trading systems is poised for further evolution. With machine learning and artificial intelligence becoming more sophisticated, these systems are likely to become even more precise and efficient in generating trading signals. Traders can expect to see increased automation and customization features to suit individual trading styles and preferences.

Additionally, as big data analytics capabilities continue to improve, radar signal trading systems will be able to process vast amounts of data in real-time, providing traders with valuable insights and opportunities that were previously difficult to uncover. With the potential for faster decision-making and enhanced risk management, the future of trading using radar signal trading systems holds great promise for traders looking to stay ahead in the dynamic world of financial markets.

India share market is experiencing a wave of transformation with the advancement of technology, including radar signal trading systems. These systems are becoming more sophisticated thanks to machine learning and artificial intelligence, offering traders more precise and efficient trading signals. With the potential for increased automation and customization features to align with individual trading styles, traders can expect a more personalized experience. Furthermore, as big data analytics capabilities improve, radar signal trading systems can process vast amounts of data in real-time, providing valuable insights and opportunities that were previously challenging to uncover. For traders looking to stay ahead in the dynamic world of financial markets, exploring the India share market with radar signal trading systems like India share market app holds great promise for enhanced decision-making and risk management.

Expert Advice on Implementing a Radar Signal Trading System

When implementing a radar signal trading system, it is crucial to start by thoroughly understanding the signals it generates. Take the time to study how the system identifies potential trade opportunities and how it generates buy or sell signals. This foundational knowledge will empower you to make more informed trading decisions and maximize the effectiveness of the system.

In addition, it is advisable to backtest the radar signal trading system using historical data before applying it to live trading. Backtesting allows you to assess the system’s performance over different market conditions and time periods, giving you valuable insights into its strengths and weaknesses. By backtesting, you can refine the system’s parameters and ensure its reliability when used in real trading scenarios.

Resources for Further Learning about Radar Signal Trading Systems

For further learning about radar signal trading systems, exploring online resources can be a valuable starting point. Websites dedicated to trading education often offer in-depth articles, tutorials, and webinars on using radar signal systems effectively. Additionally, subscribing to industry newsletters and following reputable trading blogs can provide ongoing insights and updates on the latest trends in radar signal trading.

Seeking out books written by experienced traders and experts in the field can also offer a more comprehensive understanding of radar signal trading systems. Look for titles that delve into the technical and strategic aspects of using radar signals in trading, providing practical tips and examples for implementation. Joining online trading communities and forums can further enrich your knowledge base as you engage with fellow traders using radar signal systems and exchange valuable insights and experiences.